What is VTI ETF?

Vanguard Total Stock Market ETF attempts to replicate the CRSP US Total Market Index's performance, which comprises roughly 100% of the investable U.S. stock market and contains large-, medium-, small-, and micro-cap stocks consistently trading on the NYSE and the Nasdaq.

Its main objective is to track the performance of the overall stock markets, which is less risky because of the effect of diversification.

The ETF has considerably low fees but higher than more popular ETFs replicating the S&P 500 or the Nasdaq 100, like the Invesco QQQ ETF and the Vanguard S&P 500 ETF VOO.

It holds more than 4000 stocks and is safer than other more specific and concentrated ETFs. In fact, it is considered one of the best US ETFs, alongside Invesco QQQ ETF and the Vanguard S&P 500 VOO ETF.

Preliminary Information About the VTI ETF

| Ticker | VTI |

|---|---|

| Issuer | Vanguard |

| Expense Ratio | 0.2% |

| Asset under management(AUM) | $267.45B |

| Underlying index | CRSP US Total Market Index |

| Number of Holdings | 4,003 |

| Average Daily $ Volume | $771.78M |

| Annual Dividend Yield | 1.46% |

VTI Pros and Cons

Pros:

- Diversification

- Less risky

- Low spread

- Popular

Diversification: With more than 4000 stocks held in the VTI ETF is one of the most diversified ETF out there, it procures exposure to the overall market.

As time passes, it is preferable to be globally diversified than to only invest in one country.

Less risky: As the ETF contains thousands of stocks, the risk is lower than if you invested in one sector.

Low spread: The VTI offers a shallow spread that allows you to buy and sell with the lowest fee possible.

Popular: Recently, investors worldwide are starting to allocate their money to the VTI, which is a good sign.

Cons:

- Slightly less performance

- Higher fees

Slightly less performance: Well, being diversified means you can't catch all the best-performing sectors, and we all know that each time one sector outperforms the others.

Higher fees: well, if you compare it with the other popular ETF like the SPY, QQQ, or VOO, the fees are incredibly high.

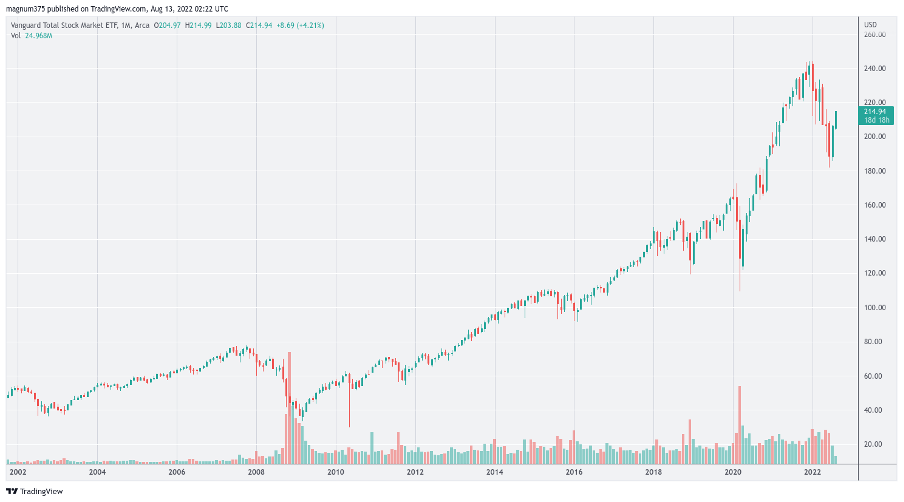

This monthly chart proves that long-term investment in ETFs is the best and easiest way to make money in the stock markets.

The VTI has performed very well for the last ten years.

VTI Holdings: Top 10

| Name | Percentage |

|---|---|

| Apple | 5.65% |

| Microsoft | 5.08% |

| Amazon.com, Inc. | 2.43% |

| Alphabet Inc. Class A | 1.74% |

| Tesla Inc | 1.57% |

| Alphabet Inc. Class C | 1.53% |

| UnitedHealth Group Incorporated | 1.27% |

| Johnson & Johnson | 1.24% |

| Berkshire Hathaway Inc. Class B | 1.21% |

| U.S. Dollar | 1.09% |

Vanguard Total Stock Market VTI holdings as of 11/08/2022. Funds may fluctuate over time.

The top 10 holdings of the VTI represent 22.33%, with Apple, Microsoft, and Amazon as the top 3 holdings.

VTI Performance

*Cumulative

| Returns | VTI |

|---|---|

| 1 Month Return | 8.55% |

| 3 Month Return | 6.57% |

| YTD Return | -11.87% |

| 1 Year Return | -6.61% |

| 3 Year Return | 48.82% |

| 5 Year Return | 84.30% |

Due to its natural diversification, the VTI performs better when the period of holding is longer.

The ETF will always recover after a correction. The world economy will return to its feet even after the most severe crisis, like in 2008 or 2000.

If you held the VTI five years ago, your portfolio would be up 85%!

How to Invest in QQQ

Step 1: Find the best Investment App

Step 2: Open and verify an account

Step 3: Make your first deposit

Step 4: Buy the VTI ETF

Conclusion

No question is needed if you are a new investor; your portfolio's easiest choice is to own the Vanguard Total Stock Market ETF.

You don't need to be an expert in the stock market. You will only follow the performance of the overall stock market.

Invest in the Vanguard Total Stock Market ETF VTI should bring you good results after a few years but just remember that investing in the stock market involves risk.