Tesla, Amazon, Google, Facebook, and Microsoft are the companies ruling the world. Many investors made money with those blue chips stocks in the last decade.

They are part of the Nasdaq 100, the technological index that contains the best 100 technology stocks.

What is QQQ ETF?

Invesco QQQ ETF is the most traded and active US ETF in the world, everyone wants to have it, and we will explain why.

The ETF is the most traded, with an average daily volume of more than 16 billion and a market cap of $172 B.

It aims to replicate the performance of the Nasdaq 100, which excludes financial stocks and only focuses on technological ones, unlike SPY and VTI ETFs which track larger indexes.

The Invesco QQQ ETF is a little risky due to the nature of the specialized industries.

Technology shapes our world, everything evolves with it, and every sector needs it to perform better and be efficient.

Preliminary information about the QQQ

| Ticker | QQQ |

|---|---|

| Issuer | Invesco |

| Expense Ratio | 0.2% |

| Asset under management(AUM) | $172.86B |

| Underlying index | Nasdaq 100 |

| Number of Holdings | 101 |

| Average Daily $ Volume | $16.02B |

| Annual Dividend Yield | 0.45% |

QQQ Pros and Cons

Pros:

- High liquidity

- Low fees

- Perform better in a bullish market

- Access the most innovative companies

High Liquidity: The Invesco QQQ ETF is the most traded in the world. The average daily volume of more than $16 B makes it the most liquid ETF.

Low fees: the expense ratio of 0.2% is meager compared to the potential performance offered by the QQQ.

Perform better in a bullish market: the correlation between the overall stock markets and the QQQ is positive, but when markets rise, the QQQ bounces even more.

Access the most innovative companies: The QQQ contains the most innovative companies in the United States and the world, like (Tesla, Microsoft, and Apple)

Cons:

- Risky

- It doesn't include small caps

- Overvalued

- One sector

Risky: High performance means more risks. Given the nature of technology and innovation, the future isn't clear.

When a company invests in a new product or innovation, the outcomes aren't always positive and easy to calculate.

The QQQ is riskier than other ETFs but has more potential profits.

Doesn't include small caps: Unfortunately, the QQQ doesn't have small caps because the underlying index, the Nasdaq 100, only contains the top 100 technological market cap stocks.

Overvalued: Almost all technology stocks have growth potential. So when you invest in these stocks, you are paying for prospective future performance.

This way, the stocks are overvalued compared to other industries; innovation means a new market and a lot of profit.

One sector: The QQQ only contains technological stocks, which might be risky if something wrong specific to this sector happens.

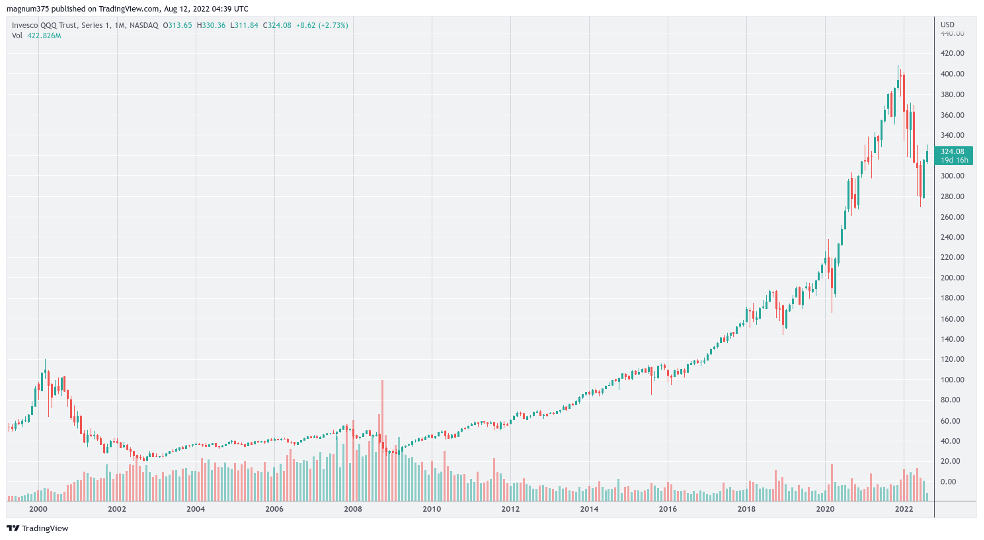

We can see QQQ ETF's explosive growth in the last 20 years.

The QQQ had an 1130% performance from 2008 until 2022, so if you invested $10 000 in 2008, you would have more than $120 000 by today!

The reason why long-term investors beat short-term traders? They don't care about a political crisis or economic news. They only focus on long-term growth. And the QQQ is the best ETF for long-term growth.

QQQ Holdings: Top 10

| Name | Percentage |

|---|---|

| Apple | 13.40% |

| Microsoft | 10.55% |

| Amazon | 7.03% |

| Tesla | 4.38% |

| Alphabet(Google) Class C | 3.69% |

| Meta Platform | 3.51% |

| NVIDIA Corporation | 3.10% |

| PepsiCo, Inc | 3.00% |

| Costco Wholesale Corporation | 1.97% |

Invesco QQQ holdings as of 11/08/2022. Funds may fluctuate over time.

QQQ Performance

*Cumulative

| Returns | QQQ |

|---|---|

| 1 Month Return | 10.35% |

| 3 Month Return | 9.90% |

| YTD Return | -17.82% |

| 1 Year Return | -10.66% |

| 3 Year Return | 78.17% |

| 5 Year Return | 134.44% |

The QQQ had an amazing performance for the last five years, but when markets plunge the ETF plummet.

The good news is that stock markets, especially ETFs, will always bounce back in the long run.

The best strategy for beginners is to buy, hold, and contribute periodically to your portfolio with more funds.

We specifically have a spreadsheet that can help you track and optimize your investment.

How to Invest in QQQ

Step 1: Find the best Investment App

Step 2: Open and verify an account

Step 3: Search for the QQQ ETF

Step 4: Buy the QQQ stock

Conclusion

Well, the answer is technically a yes! If you believe in companies like Tesla and Apple, then the QQQ will outperform.

And as we all know, the stock markets always go up in the long run.