Transferwise vs. Paypal: Fees

Although both platforms offer an alternative to sending money via banks, their services don't come free. TransferWise and PayPal charge a small commission on their transactional services. See Transferwise vs. Paypal fees below:

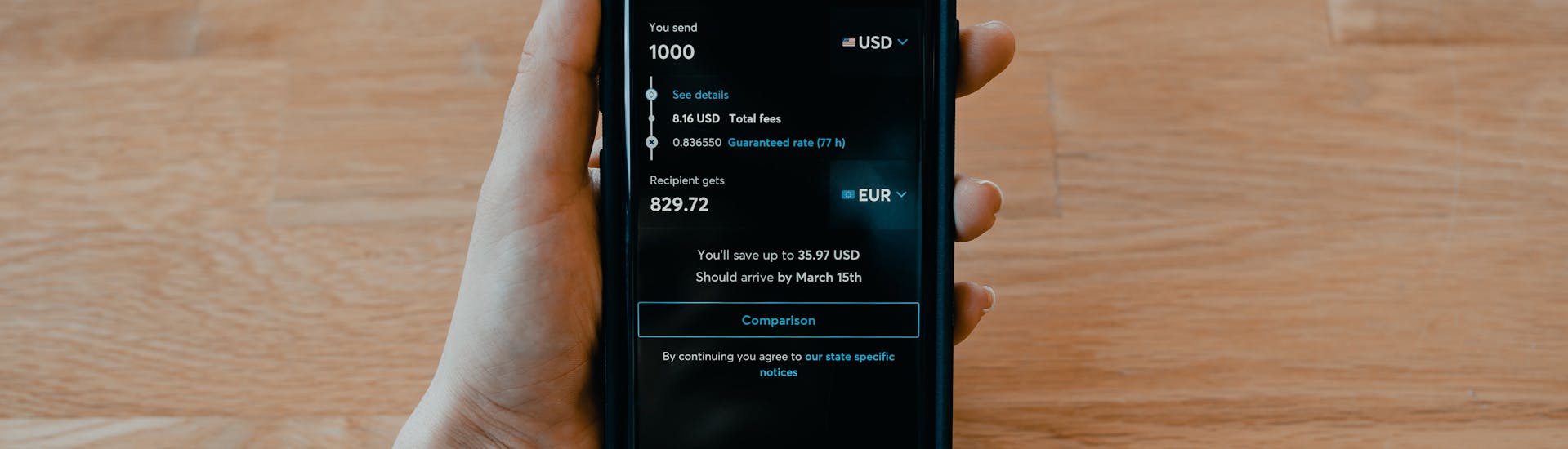

Wise

Wise has transparent fees for all their transactions. Simply enter details on the Wise homepage and use their calculator to see your transaction fees whenever you want to make a transaction.

International money transfer charges vary between 0.4% and 2%, depending on the currency and type of payment. To deposit to Wise Borderless account, the charges range between 0.4% and 0.5%. To convert between your Borderless account, you'll be charged 0.3% - 0.6%, but 0.1% if you're sending money out of the account.

There are no fees for card issuance, and it's free to make cash withdrawals of up to $250. If you exceed this limit, it costs 2% of the amount.

PayPal

PayPal has more complicated charges for different locations and services.

If you're sending money on PayPal within the US using PayPal Cash, PayPal Cash Plus, or a linked bank account, there are no charges. Paying with a credit card, debit card, or PayPal Credit costs 2.9% of the amount and a fixed fee.

International money transfers via any payment method—PayPal Cash, PayPal Cash Plus, credit card, debit card, PayPal Credit, or a linked bank account—cost 5% of the transfer amount for transactional fees. International PayPal cash payments cost no funding fees. However, payment via any type of card or PayPal Credit costs a funding fee of 2.9% of the transfer amount and a fixed fee.

Selling fees in the US cost 2.9% and $0.30 per transaction. Selling internationally costs 4.4% and a fixed fee depending on the currency. Selling via PayPal Here card reader costs 2.7% for card swipes, or 3.5% and $0.15 for manual transactions.