When you are a new investor, you must be confused with all the financial jargon that investment professionals use to describe what is happening on the market.

You probably already heard someone says that as a beginner, you should invest passively in an ETF or a stock index and let it run.

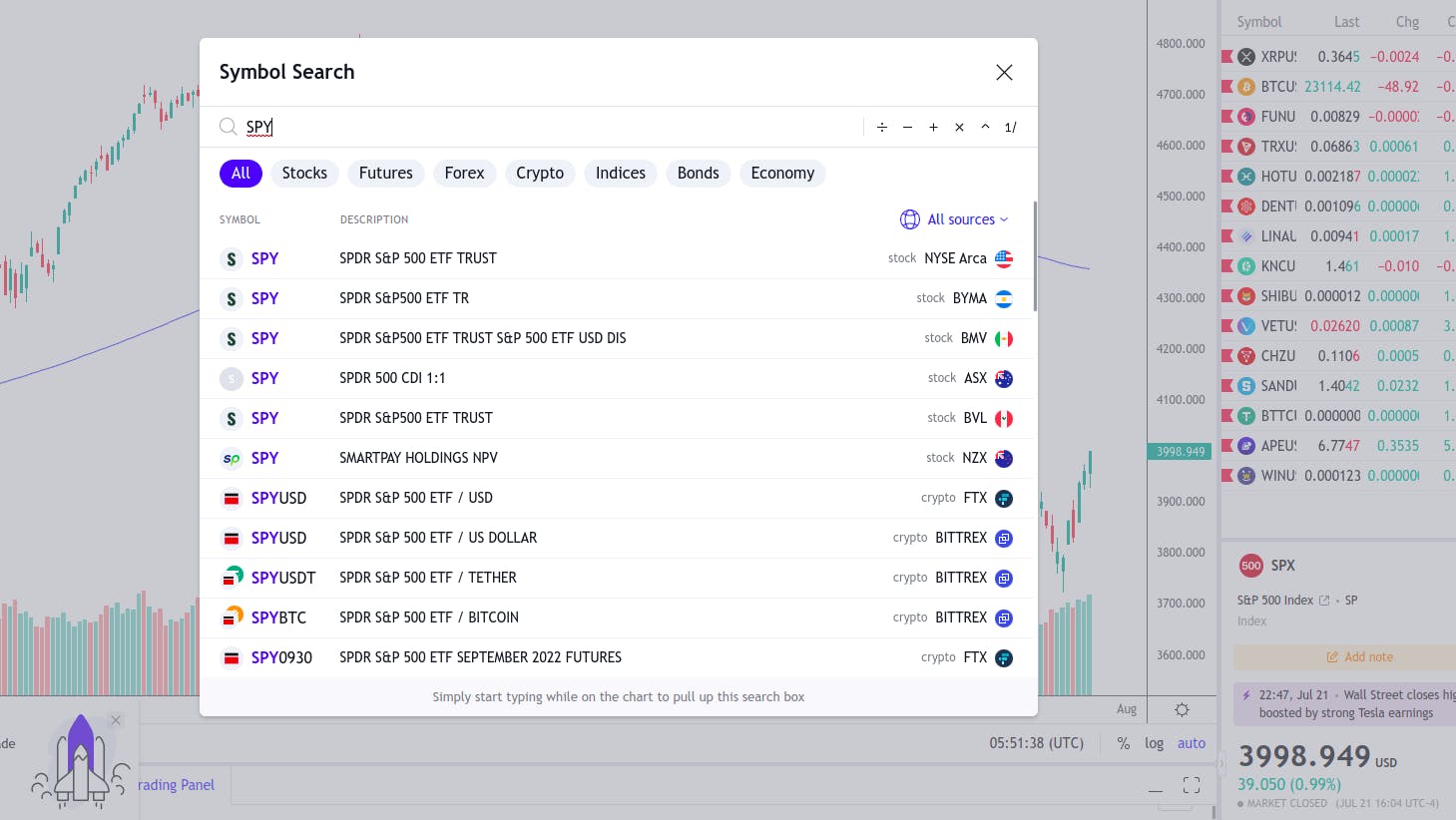

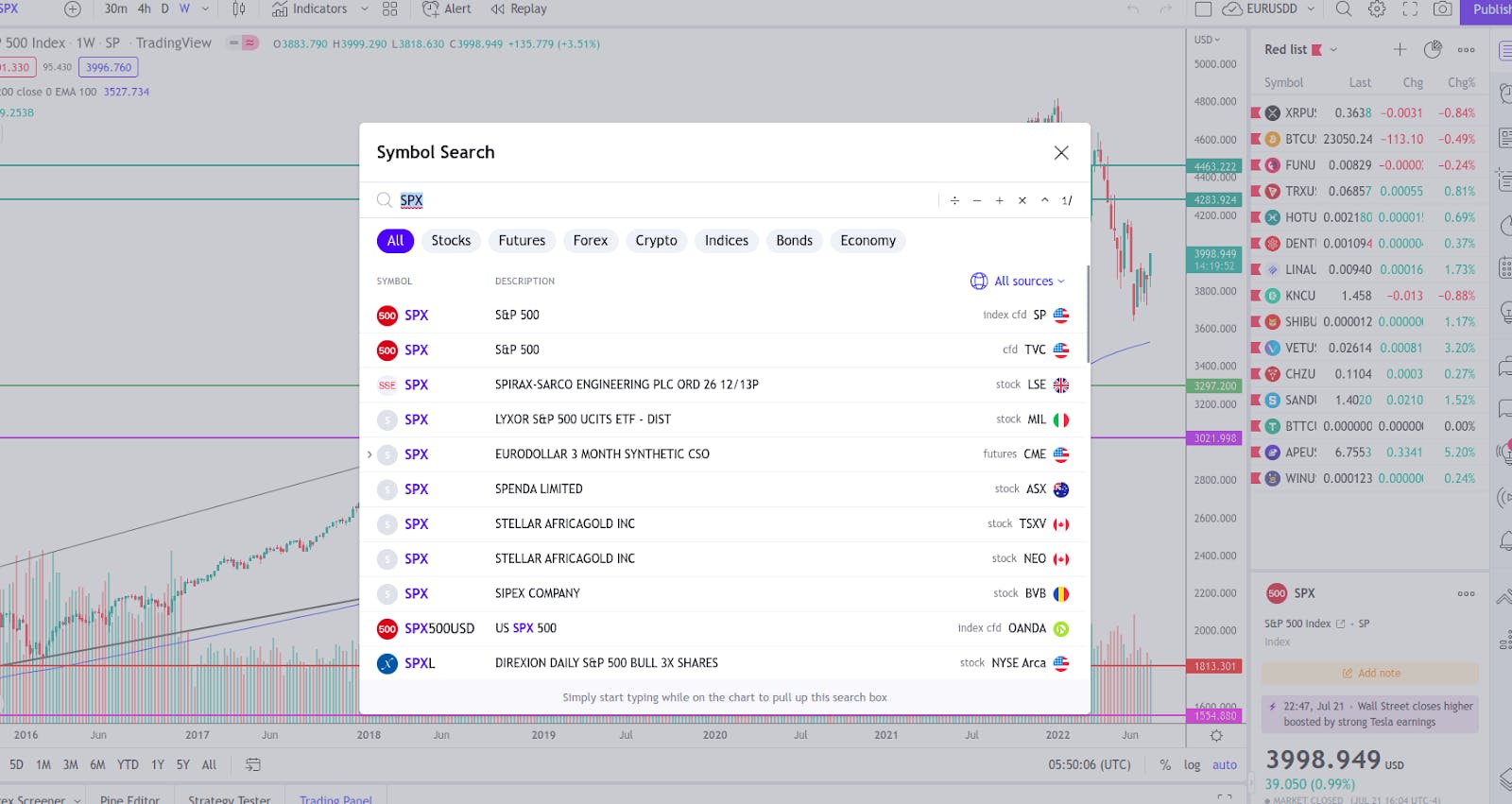

But how will you do that exactly? We will explain the main difference between the SPY Vs SPX, two different acronyms representing the S&P500, the most general US stock index.