We are aware that many of the people that have fled the country could not bring a lot of money with them for several reasons. Therefore, we have created this guide, to help those who’s money is still in a Ukrainian bank account.

We hope that this guide will help as many refugees as possible to create an international bank account which will help them:

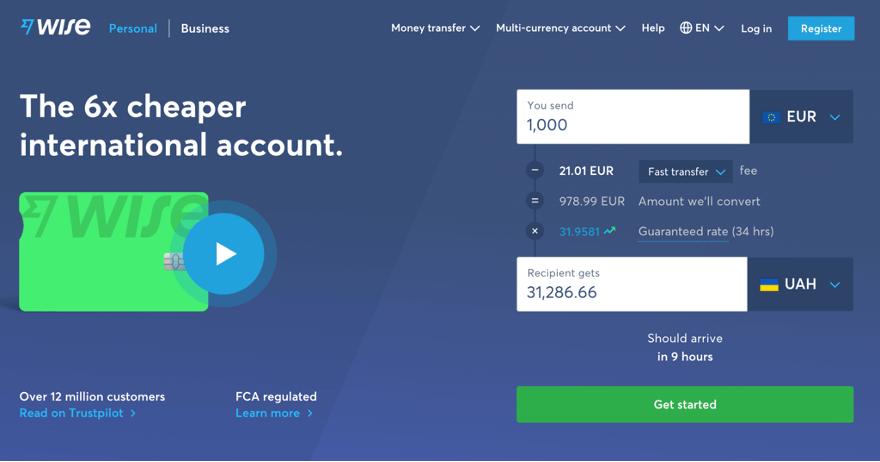

- Transfer money from Ukrainian bank account

- Receive family from family and friends that live outside Ukraine

- Exchange Ukrainian hryvnia to Euros or any other currency instantly and at some of the best possible rates

- Get a digital debit card that you can used anywhere in the world

- Make low-fee payments

- Make free ATM withdrawals

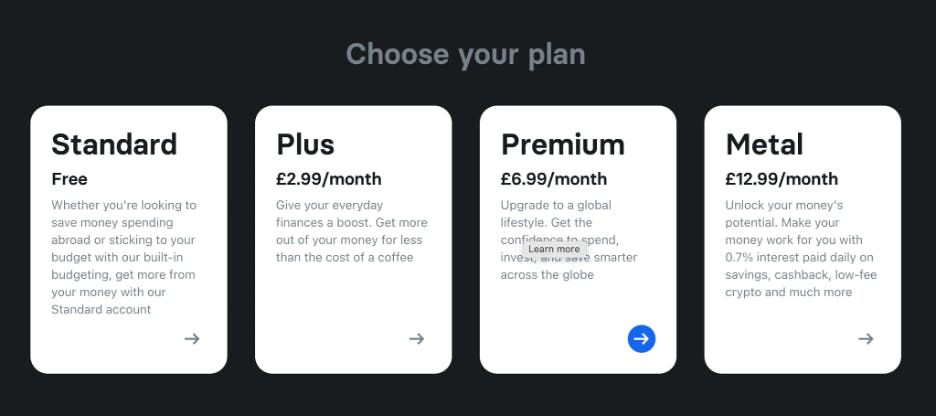

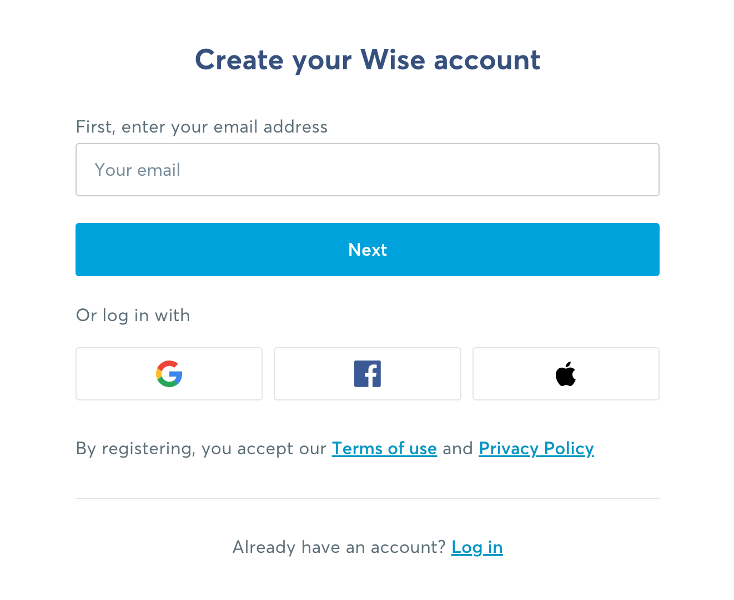

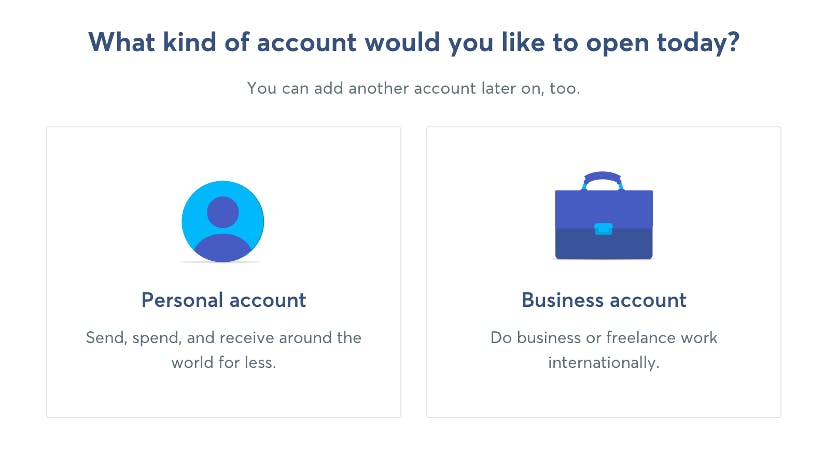

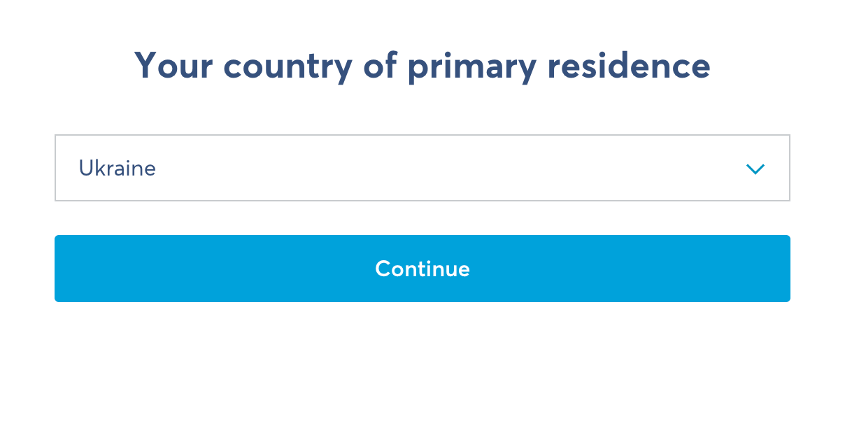

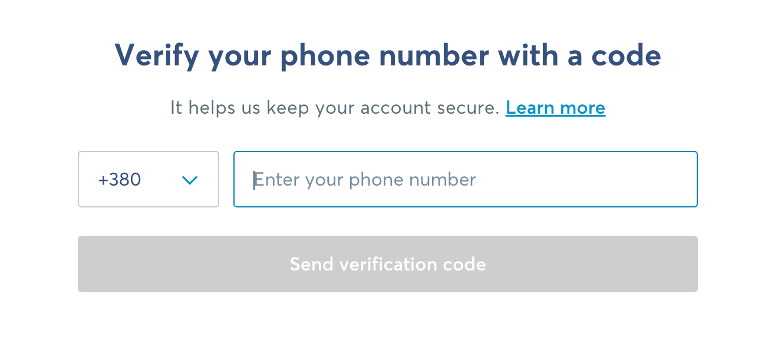

In this article, we will teach you how to open an account with a digital bank like Wise or Revolut and how to properly use it.

DISCLAIMER: WHILE SORTTER USES AFFILIATE MARKETING MODEL, THIS ARTICLE DOES NOT CONTAIN ANY AFFILIATE LINK.