What is VOO ETF?

Vanguard S&P 500 ETF is currently the second-largest exchange-traded fund focused on the benchmark index. It has more than $269 billion in assets, trailing only Vanguard’s other S&P 500 ETF, the VOO. Many consider it to be one of the best US ETFs, alongside VTI and IVV.

Intended to track the S&P 500, it holds a broad basket of large, medium, and small stocks.

VOO charges an annual expense ratio of 0.03%, which is on the lower side when compared with its competitors.

Preliminary Information About the VOO ETF

| Ticker | VOO |

|---|---|

| Issuer | Vanguard |

| Expense Ratio | 0.03% |

| Asset under management(AUM) | $269.38B |

| Underlying index | S&P 500 |

| Number of Holdings | 503 |

| Average Daily $ Volume | $1.71B |

| Annual Dividend Yield | 0.45% |

VOO Pros and Cons

Pros:

- US exposure

- Low Fees

- Liquid

- Diversification

Us Exposure: The VOO replicate the S&P500, which is the index that represents the US economy, by having the VOO in your portfolio you get access to the best companies in the US.

Low Fees: Compared to its peers or active funds, the VOO has the lowest fees on the market with only a 0.03% expense ratio.

Liquid: The Vanguard S&P 500 ETF is among the most liquid ETFs in the market, with more than $269 Billion in AUM (Asset under Management) and a daily average volume of $1.71B.

Diversification: The S&P500 contains the most profitable and the biggest companies my market capitalization in the US, and by having more than 500 holdings the fund is well diversified.

Cons:

- Low Dividend Yield

- Non-international exposure

Low Dividend Yield: The VOO has an annual dividend yield of 0.45% which is a low yield compared to owning a dividend ETF.

Non-international exposure: The Vanguard S&P 500 ETF only invest in US companies and has no interest in international companies that might have great returns.

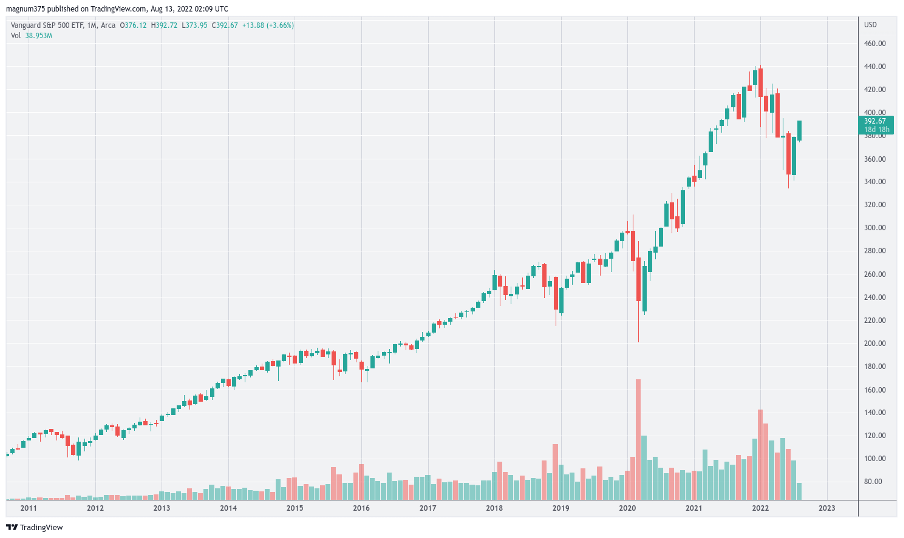

For the last ten years, the VOO has kept growing tremendously, with some corrections in 2019-2020 and early 2022.

But overall, if you invested in 2012, your portfolio will be very worthy by now.

VOO Holdings: Top 10

| Name | Percentage |

|---|---|

| Apple | 13.40% |

| Microsoft | 10.55% |

| Amazon | 7.03% |

| Tesla | 4.38% |

| Alphabet(Google) Class C | 3.69% |

| Meta Platform | 3.51% |

| NVIDIA Corporation | 3.10% |

| PepsiCo, Inc | 3.00% |

| Costco Wholesale Corporation | 1.97% |

Vanguard VOO holdings as of 12/08/2022. Funds may fluctuate over time.

Apple, Microsoft, and Amazon are the top 3 holdings for the VOO. They are stocks that everybody wishes they had invested in ten years ago.

VOO Performance

*Cumulative

| Returns | VOO |

|---|---|

| 1 Month Return | 8.74% |

| 3 Month Return | -0.03% |

| YTD Return | -12.06% |

| 1 Year Return | -4.67% |

| 3 Year Return | 45.54% |

| 5 Year Return | 82.49% |

It is clearly shown that long-term investing or buy and hold strategy is the best for the regular investor.

If you invested five years ago, your portfolio would be up 82.49%! Imagine if you invest now and wait for ten years.

But our best advice is to have three to four ETFs, including the VOO to have a well-diversified portfolio.

Our choice will tend toward risky or technological ETFs like the QQQ(Nasdaq 100), the VOO(S&P 500), plus a general ETF like VTI.

How to Invest in VTO

Step 1: Find the best Investment App

Step 2: Open an account and verify your identity

Step 3: Make your first deposit

Step 4: Buy VOO ETF

Conclusion - Should You Invest in the VOO ETF?

The Vanguard S&P 500 ETF VOO is an excellent choice if you want long-term returns and low fees.

You don't even need to pass all your time checking the chart of the S&P 500 daily.

The only thing you need to do is to monitor and track your portfolio once in a while using our top-rated investment tracking spreadsheet.

But keep in mind that investing in the stock market doesn't come with any guarantees - you can end up losing money just as easily.