Investing your money is regularly encouraged, and investors are often reminded of the importance of investing specific amounts of their income into the markets consistently over long periods. Selling your stocks, however, is rarely mentioned and even discouraged. Despite this, knowing when to sell your stocks is as important as knowing when to buy them. This leads many investors to ask, when is the best time to sell stocks? Let's explore the answer to that question now as we try to understand the art of selling stocks.

Reasons to Sell

Fundamental Change

Investors should never forget that stocks represent a piece of ownership in an underlying business. It is the reality of ownership in a company that brings us our first reason to sell a stock: a change in the fundamentals of the company.

Change is the only constant in life and companies are not exempt from this universal law. Occasionally, the fundamental aspects of the underlying business may change, and this will provide investors with a good reason to sell their stocks. This change in the fundamentals may come in many forms; it may be the company's management taking it in a new direction. It may also be the result of political or macroeconomic shifts.

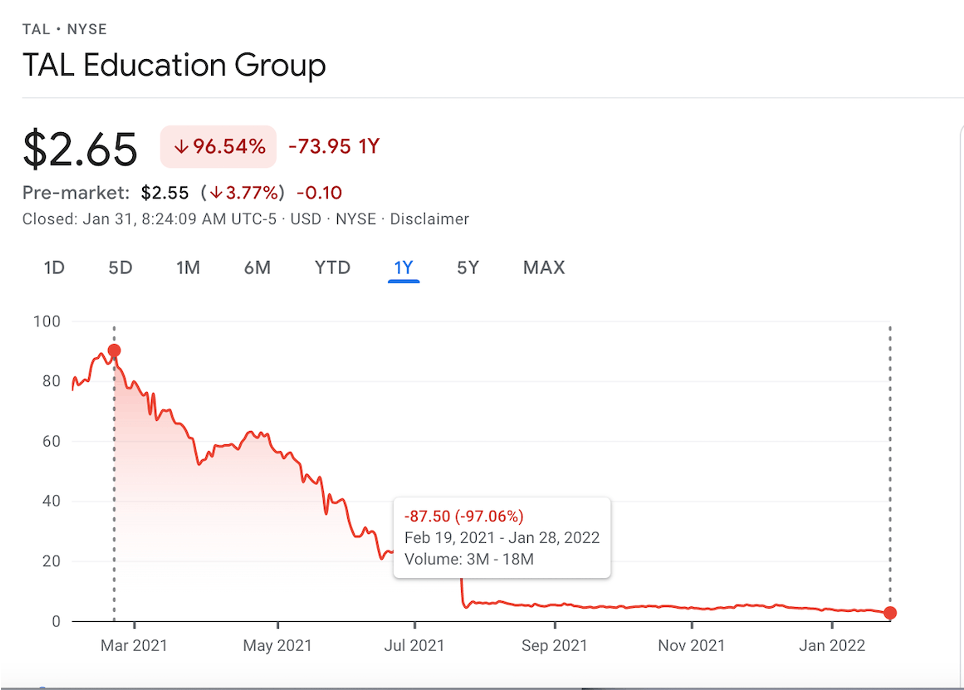

For example, in early 2021, the Chinese Government clamped down on online education companies, effectively preventing their business models from operating. This political shift caused a fundamental disruption to the operations of companies like EDU and TAL Education. As a result, investors would have been well-advised to sell these stocks as they proceeded to decline over 97% in value from February 19th, 2021, to January 2022. Therefore, fundamental changes to a company are an excellent example of when to sell stocks at a loss.

Opportunity Cost

The disappointment of limited resources and opportunity costs provides us with our second reason to sell a stock. Unless you're the U.S Federal Reserve, you likely only have a finite amount of money to invest into assets. Therefore, you will need to decide where best to allocate your capital to maximize your returns over time. By extension, this means that investing in one asset automatically prevents you from investing in another.

Opportunity cost, therefore, affords us a reason to sell stocks if you have found something better to invest in; let's look at this in practice.

Imagine that you had purchased Apple stock in 2001 and held it in for the following 11 years. If you had invested in January 2001 and sold in January 2012, your position would be up a whopping 4462%. However, in 2012 you discovered a new type of asset called Bitcoin and believed that this asset would grow in value exponentially over the following years. While you still believe that Apple is a fantastic company with impressively strong growth prospects, you believe that Bitcoin will outperform Apple in the future. In this circumstance, you would be right to sell your Apple shares in favor of relocating some of that capital to Bitcoin.

Diversification

Our third reason to sell a stock derives from the prudent investor's need to manage risk and diversify their portfolio. Every so often, investors get it right, and their holdings grow larger than they would have imagined.

Borrowing from the example above and assuming your investment into Apple had grown over 4000%, likely, that Apple stock would now be your largest holding. Having too large a position in a single holding exposes your portfolio to significant risk. As such, you would be wise to trim the position down by selling portions of it and relocating the capital to alternative investments.

In the example above, the intelligent investor would have trimmed down some of his Apple stock and relocated part of that capital into their new Bitcoin investment thesis. This would have allowed them to both capitalize on any potential gains they believed Bitcoin would have had while still maintaining a strong position in an already successful company. The need for diversification is an excellent reason to sell stocks for profit.

Personal Targets

Every investor makes their investments for their own personal reasons; this is why we call it personal finance. Some invest to help save for future purchases like a home or wedding. Others invest to help secure their retirements. Some investors simply invest to make as much money as possible. Whatever your motivation for investing, it is important to set personal targets for your investing career, and these targets provide us with our final reason to sell a stock.

Let us assume that you are interested in purchasing your first home but do not currently have enough saved to secure a mortgage. You invest your $10,000 in savings in the hope that your investments will grow as you slowly contribute more towards your portfolio on a monthly basis. You require $50,000 to secure the mortgage and therefore make this your personal target. Reaching that $50,000 goal would be a perfectly valid reason to sell your stocks, and you would be right to do so.

When not to Sell

Let's look at the three top reasons not to sell your stocks.

Price Increase

Price fluctuations are common in the stock market as hundreds of millions of shares are bought and sold daily. A common misconception among new retail investors is that they should sell stocks once they have risen to a specific point. This kind of investment decision is responsible for immeasurable losses.

Assets like stocks can rise significantly in value over time. Therefore, a price increase in your stock, especially a short-term increase, is not a good reason to sell a stock. Apple is the perfect example to illustrate this point. If we were to examine Apple's chart below, we would see that over the last 20 years, the price has steadily increased.

Indeed, there is no "good time" to have sold Apple stock over the last 20 years because of its price constantly increasing. Any investor who sold their Apple stock during the previous 20 years simply because the price increased would have made a grave error in judgment.

Price Decrease

As the market endures turbulence, investors become fearful of crashes or corrections. This fear causes selling pressure to increase dramatically, further driving down the values of stocks quickly. It is during these times of panic that investors should refrain from selling their stocks.

In truth, most investors who lose money in the financial markets do so not because they invest in the wrong stocks but because they panic and sell the right stocks at the wrong time.

Price fluctuations work in both directions, and occasionally, the values of good companies plummet in the wake of wider macroeconomic catalysts. A susceptibility to fear is an investor's worst enemy, leading investors to make terribly poor investment decisions. Selling your stock simply because it has fallen in value is one of the worst decisions an investor can make. Let's demonstrate this point using one of the most popular stocks on the market as an example.

As you can see above, on January 8th, 2021 Tesla's stock price began to fall from its then all-time high of $880 a share. The stock continued its decent for months, falling as much as 32.99% by May 14th. This 4 month-long decline led to widespread fear among Tesla investors who began to believe that perhaps the company was overvalued and that it may be wise to cut their losses and reinvest into other assets.

Had you counted yourself among those fearful few, you would have missed out on the strong returns Tesla provided its investors with over the following 6 months as Tesla's stock price flew to $1,200 per share. Do not sell your stocks solely because the price has fallen.

Price Stays Flat

Occasionally, stocks will trade sideways for some time, staying mostly flat without providing investors with any real losses or profits. Although this may not seem difficult to endure during bull markets where assets are soaring in price, and other investors are reporting massive returns, it can be extremely difficult to maintain your conviction in sideways trading stocks.

Patience can be an investor's most trusted ally in the war of capitalism. If you have done your research and feel confident that the company you have invested in has strong growth prospects well into the future, do not sell your stock because the price has remained flat. After all, readers need only look at the Apple chart above to realize that even Apple traded sideways for the better part of a decade.

Conclusion

Whether you have already invested in the markets or are still sitting on the sidelines preparing your cash, knowing not only when to sell but also when to buy stocks is an important skill to develop.

The above reasons to buy and sell stocks will serve new investors as a good general guide to buying and selling stocks on the financial markets. As is always recommended, investors should do their research and come to their own conclusions before putting any capital at risk by purchasing assets.