Learning how to do technical analysis can seem like a daunting prospect to many who consider diving into the financial markets. The weight of learning about chart patterns, candlesticks, indicators, and market trends understandably becomes overwhelming for many new traders.

While learning to perform technical analysis is not easy, it is far from impossible. Every day, traders log into their brokerages and successfully apply their technical analysis skills to navigate through the financial markets profitably. This guide is intended to provide new traders with an insight into the basics of technical analysis. We hope it will serve as a reference point from which inexperienced traders can continue to grow their knowledge and understanding of technical analysis well into the future.

Let's get started!

What is Technical Analysis

Technical analysis is a trading methodology that uses data points to determine whether the price of an asset will rise or fall. These data points can come from several different sources such as chart patterns, indicators, the volume of trade shares, and the price action of the specific equity. Traders analyze these data points in an attempt to determine the probability of an asset rising or falling in price. Once they have determined that probability, they enter their trades accordingly, trying to profit from the forthcoming price movements.

Limitations of Technical Analysis

Sadly, technical analysis is not an exact science. If it were, the number of billionaires would begin to steadily increase over time. Let's explore some of the limitations of this trading methodology so that we might better understand how it can be used to benefit traders.

Subjectivity

The first and perhaps most significant limitation of technical analysis is that it relies on the subjective interpretations of data that differ from trader to trader. In practice, most traders have access to the same data points. They are all viewing the same chart patterns, utilizing the same indicators, and accessing the same metrics.

However, the way they interpret these data points may differ from trader to trader. It is entirely possible for two traders to examine the same stock chart and reach entirely opposite conclusions about the future price movements of that equity.

As a result, one of the most significant limitations of technical analysis is that it relies on the subjective interpretations of each individual trader.

Accuracy

Since technical analysis is not an exact science, the results provided by a technical analysis are not always as accurate as traders might prefer. Even when many analysts reach similar or identical conclusions, there is ultimately no way to predict what the price of an equity will do with any reasonable certainty.

As such, another limitation of technical analysis is that the analysis it provides is not always accurate.

Short-Term

The reliability of technical analysis wains with every second that passes. The more time passes, or the further analysts attempt to forecast, the less reliable the analysis is.

Therefore, the final limitation of technical analysis is its unsuitability for long-term investors who are interested in making long-term investments for the future. Technical analysis may provide you with insight into what the price of an equity will do tomorrow, but it has little hope of telling you where that equity price will be in five years.

Find the Best Trading App for You

Technical Analysis vs Fundamental Analysis

If technical analysis is the study of price charts and data points to determine future price action, what is fundamental analysis? Fundamentalists believe in examining the specifics of a company. They access the company's financial statements, business model, management team, and other metrics such as sales, revenue, and net profits to determine whether they should invest in an asset.

Naturally, the most pressing question most people will be asking is which methodology is best?

The debate over which trading methodology is superior is ongoing. Adopters of each regularly denounce the merits of the other and far too often misunderstand that each of these trading philosophies has its place.

Generally, technical analysis is used for short-term trades that attempt to time the market and identify optimal entry and exit points. Adopters of technical analysis would either be day traders or long-term investors trying to identify the best times to add more shares to their positions.

Fundamental analysis takes the opposite approach. It can and should be used to invest in assets when the intention is to hold them over long periods of time. However, you would be foolish to attempt to use fundamentalist data to attempt to predict short-term movements in the price of an equity.

Many market commentators make the case that fundamental and technical analysis are these two competing schools of thought, but this is a foolish belief. The truth is that technical and fundamental analysis are simply two sides of the same coin. In practice, technical analysts will ride on the winds of fundamentalists.

These situations of mutual partnership between fundamentalists and technical analysts become especially noticeable in times of crisis and uncertainty.

For example, the March 2020 crisis in the US markets was caused by the panic of the Covid-19 pandemic. Soon after the World Health Organisation declared Covid-19 a global pandemic, prices of equities reached unjustifiably pessimistic levels. At this point, fundamentalist investors began to pick up the shares at outrageously discounted levels. Once this occurred and a reversal was clearly taking place, technical analysts began to move into stocks and commodities to ride the uptrend being caused by fundamentalist capital.

How to Read a Stock Chart

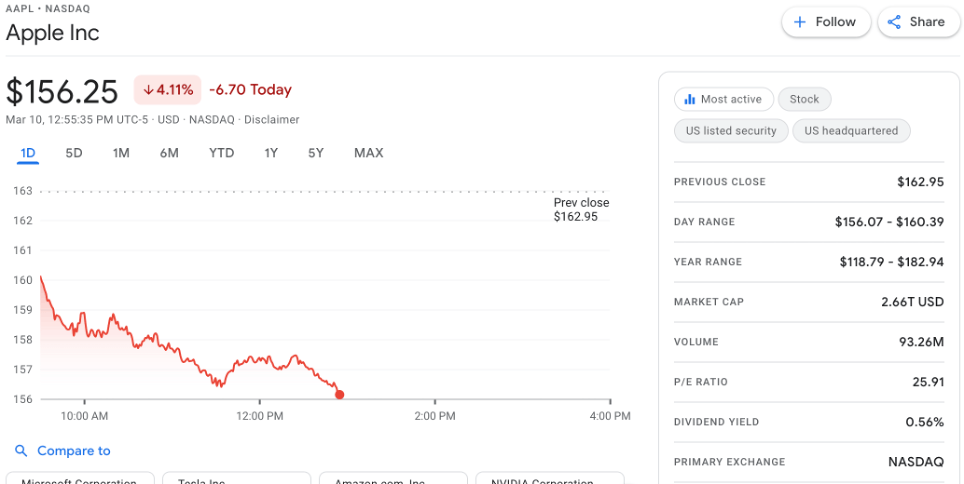

At first glance, reading a stock chart can be an intimidating activity as readers are blasted with lines, colors, graphs, and numbers. However, once you have broken them down, reading stock charts can prove to be a very manageable task. To demonstrate this, we will read through the stock chart of one of the world's most popular companies, Apple (AAPL). You can find their stock chart taken directly from Google Finance below.

The graph itself is highly intuitive, and many new investors will be able to determine what they are looking at fairly quickly. It shows Apple's current stock price ($156 per share) as well as the movement of the day (4.11% down or $6.70).

Below the stock price, investors can see the various time frames that are available to view Apple's price data. Investors can examine Apple's chart back to 1982 when the company first went public. The various options include 6 months, 1 year, 5 years, and YTD which stands for Year to Date (from January 1st of that year to the current date).

On the right of the stock, Google Finance also provides some basic information about that equity. Occasionally, this information is located below the chart. The specific format for the chart will change depending on the charting provider or platform. Now, let's look at what each of these terms means and why they are important.

Previous Close - The previous close refers to the final price of the equity on the last prior trading day. Our example shows Apple's chart on March 10th, 2022. This means that on March 9th Apple finished the trading day at a stock price of $162.95.

Day Range - The day's range refers to the highest and lowest price that stock has traded to within that specific trading day. On March 10th, 2022, Apple traded as high as $160.39 per share to as low as $156.07.

Year Range - Similar to a day range, the year range measures the highest and lowest amounts that a stock has traded over that year. The year range begins on the first trading day of the year and ends on the final day of trading for that year. As you can see, Apple started the year trading for $118.79 per share and has traded as high as $182.94 since that time.

Market Cap - A company's market cap refers to the total amount of money invested in that space. For example, if a company has 100 shares at $10 per share, its market cap would be $1000. At the time of writing, Apple boasts a market cap of 2.6 trillion USD making it one of the largest companies in the world. Market caps are useful information to traders as it helps traders to identify how volatile a stock might be. Generally, the larger a company is, the more docile its stock moves are. This is because larger companies would require significantly more shares to be bought or sold in order to move their stock price. It is entirely possible for a 500 million dollar market cap company to increase 100% in value over a trading day with very positive news. It would be next to impossible for companies as large as Apple to make such a drastic move.

Volume - Volume is an especially useful metric for trading as it refers to the number of shares changing hands. In our example above, 93 million shares of Apple have been bought or sold within that trading day. Volume is useful to traders as it may indicate volatility in an equity. If an equity's volume is much higher than usual, the price will move more significantly than it typically does. Traders will actively seek out volatility as this is where trading opportunities will be found. Therefore, volume is an important metric for traders to keep an eye on.

P/E ratio - At its most rudimentary level, P/E ratios (price/earnings) are a simple way for investors to gauge how expensive an equity is. A P/E ratio is calculated by dividing the share price by its annual earnings per share. The figure demonstrates the amount of money you are paying for each $1 the company earns. For example, Apple has a P/E ratio of 25. This means that you are paying $25 for every $1 of Apple's earnings. The lower the P/E ratio, the cheaper the stock is in comparison to the amount of money that company has earned.

Dividend Yield - Not all companies pay their shareholders dividends, but those that do will have a dividend yield (link to dividend aristocrats article). The dividend yield refers to the percentage of the company's share price that is paid out in dividends each year. For example, if a company has a stock price of $10 per share and pays out $1 per share in dividends, its dividend yield is 10%. Dividend yields are vital information for dividend investors who invest in companies to produce cash flow.

Primary Exchange - The primary exchange refers to the main exchange on which the shares of a company are traded. For Apple, its primary exchange is the US NASDAQ. Please note that companies can be listed on multiple exchanges across the globe.

Understanding Candlesticks

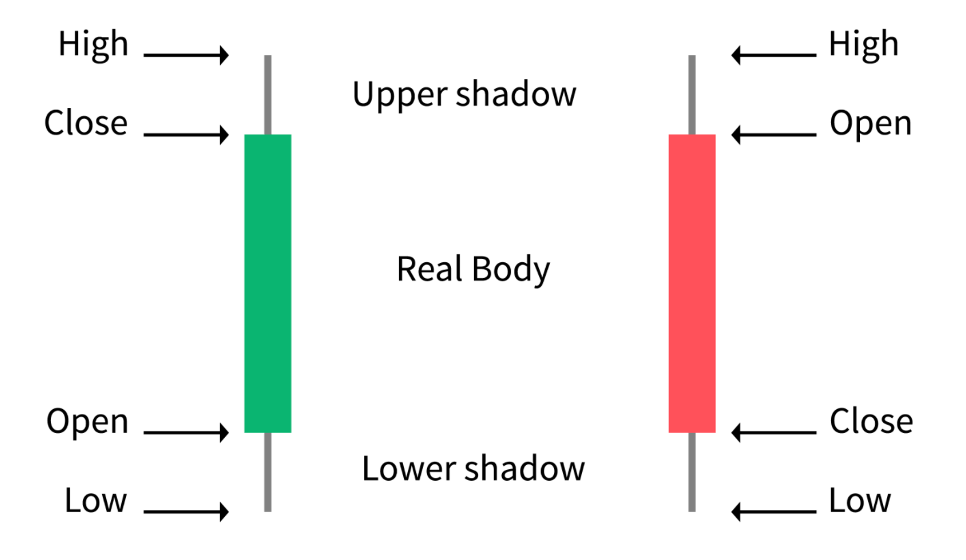

To understand more advanced trading strategies, traders must first comprehend the basics of candlesticks. A candlestick is merely a type of price chart used in technical analysis that provides traders with specific price data.

To create a candlestick chart, access to the following four pieces of data is required:

- Open price

- The highest price for a chosen time period

- The lowest price in that same period

- The closing price for that time period

These time frames can range from 1 minute to several hours and are entirely up to the individual trader. Now, let's take a look at what a candlestick looks like.

Above, you can see both positive (price is moving up) and negative (price is moving down) candlesticks. As you can see, the colored portion of these two candlesticks represents the body of the candlestick.

The body of the candlestick informs traders of where the price opened and closed during their chosen time frame. The two lines on either end of the body are called the shadows. The shadows (or wicks) show traders the highest and lowest price during their chosen time frame.

If we take the 5-minute candlestick for Apple (AAPL), the body would show the open and close price in that 5 minutes and the shadows would detail the highest and lowest price.

How Candlesticks are formed?

Candlesticks are a visual representation of price action and form through the price fluctuations of the equity they are tracking. Many traders consider candlesticks to be much more visually appealing than other methods of representing price action.

Using these candlesticks, a trader can rapidly decipher the relationship between the open and the close as well as the high and the low during their selected time frame. This information is vital for traders and forms the basis of candlesticks.

Candlestick Types

Not all candlesticks are created equal, and there are a number of different types of candlesticks that traders should be aware of. While it is beyond the scope of this post to sufficiently cover every type of candlestick, we will provide a comprehensive list of the 12 main types of candlesticks.

- Big Candles

- Dojis

- Gravestone

- Dragonfly

- Shooting Star

- Hammer

- Morning Doji Star

- Evening Doji Star

- Bearish Harami

- Bullish Harami

- Engulfing Bullish

- Engulfing Bearish

Each one of these types of candlesticks provides traders with different information that helps to inform their trading decisions. Any reader who is serious about learning to trade and conduct a technical analysis should be familiar with the types of candlesticks mentioned above.

Identifying Trends

A trend refers to the overall direction of a market or assets price. Although the day-to-day price fluctuations of an asset may rise and fall, if the overall price goes up over time it is said that the price is trending up. Similarly, if the overall price is falling, then it is said that the price is trending down.

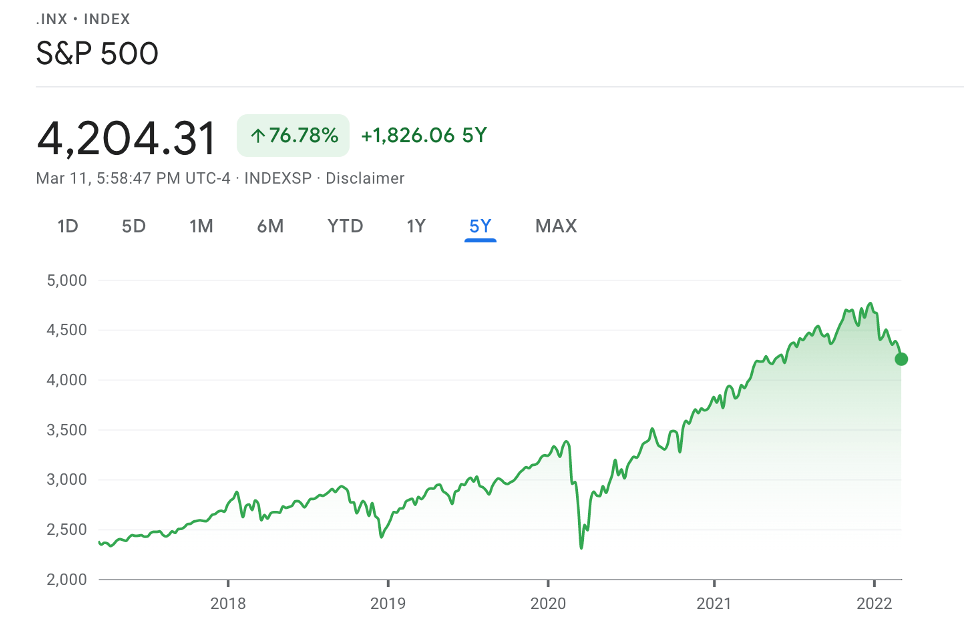

Below you will find a price chart for the S&P 500 index over the last five years. As you can see, although there have been significant declines over the last several years, the market is generally trending higher. This is what we would classify as an up-trending market.

Identifying a trend is a relatively easy process as most traders will be able to visually see any trends on charts if they zoom out far enough. Although determining which direction a stock is trending is relatively straightforward, identifying when or if that trend will change direction is significantly more complex.

Identifying Trend Reversals

A trend reversal refers to a situation where a trend changes course. For example, a stock may be trending upward for several months and then due to a variety of factors, may begin trending down.

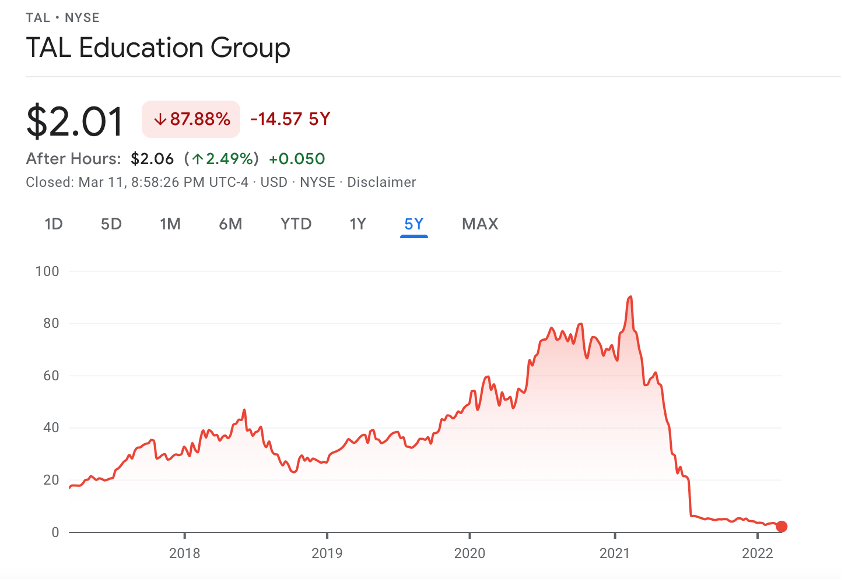

As you can see in the example below, TAL Education Group had generally been trending upward for several years before geopolitical and regulatory problems caused a trend reversal which sent the stock plummeting to all-time lows.

Identifying a trend reversal is never an easy thing to do as trends can reverse for a number of different technical or fundamental factors. In the case of TAL Education Group, the trend reversal was caused by severe fundamental problems with the company.

When using technical data to identify a trend reversal, traders typically rely on specific technical indicators. We will cover some of these indicators in more depth below.

Identifying Support & Resistance Levels

Support and resistance levels are key indicators that traders use when attempting to identify a change of direction in the price of a stock. Let's briefly examine what we mean when we refer to support and resistance.

A support level refers to the point where a stock will stop falling in price. During a downtrend, stocks will continue to decrease in price. Sooner or later, these stocks will hit a "floor" beyond which the price will be reluctant to fall below. This theoretical floor is described as a support level.

Resistance levels are the polar opposite of support levels: the point where they stop rising. As prices trend upwards, markets and stocks will continue to rise in price. At some point, these stocks will hit a theoretical "ceiling" beyond which the price will be reluctant to rise. This ceiling is described as a resistance level.

As a general rule, stocks will trade in between these support and resistance levels. Prices will fluctuate between the two levels, rising off the support line when the price falls or falling from the resistance line when the price gets too high.

Now that you know what support and resistance levels are, you will likely be curious about how you can identify them. Distinguishing between the white noise generated by random price fluctuations and genuine support and resistance levels can be challenging. However, there are several methodologies that traders can employ to do this. Let's cover one of the most straightforward strategies traders use to identify basic support and resistance lines.

This strategy attempts to use historical price data to identify these support or resistance lines by looking at the highs and lows of that strategy. The logic behind this method is that, once the highs and lows have been located, traders can track how many times the price of the asset hits them.

The scientific method requires that to test a hypothesis; one must conduct a controlled experiment. If the results of this experiment are repeatable and remain consistent, then one can reasonably conclude that the result is reliable. Let's look at how this experiment might work in practice.

Assume that a trader has examined a stock's historical price data and believes that the asset has a resistance level at $100 and support at $50. The best way to test this theory is to examine the chart and ask how many times the stock hit these support and resistance levels? The more frequently the price of an asset falls to support and rises or rises to resistance and falls, the more reliable the conclusion that there is support and resistance at these levels.

Support and resistance levels are key technical indicators that traders can use to find trend reversals. For example, if a stock falls through a strong support level that has been tested many times over the previous months, it is possible that the uptrend has reversed, and the price will now begin to trend down.

It should be noted that support and resistance levels are only one form of technical indicator that traders use to inform their decisions. In the section below, we will briefly cover some of the most popular technical indicators used by technical analysts.

Technical Indicators

A technical indicator is a mathematical calculation that uses metrics such as historical price data, volume, and open interest to forecast the direction of a specific market or asset. This section briefly examines three well-known indicators being utilized by traders in financial markets.

RSI

The Relative Strength Index (RSI) indicates whether a stock is on a bullish or bearish trend. The fundamental purpose of the RSI is to calculate the speed at which traders are driving the price of an asset up or down. The results of the RSI are plotted on a scale of 0-100 that traders can use to help inform their decisions.

An RSI reading below 30 generally indicates that the stock is oversold. This means that buying pressure will likely re-enter the asset and that the price will begin to move up. Conversely, an RSI reading above 70 typically indicates that the asset is overbought. When assets become overbought, they are likely to draw selling pressure from investors, which will drive the price of the asset down.

Generally, it is a buy signal if an RSI moves below 30. It is a buy signal because an RSI below 30 indicates that the stock has been oversold and is ready for a reversal. Similarly, you may also generally consider an RSI reading above 70 to be a signal to close your positions as it indicates that the asset has been overbought and is likely to endure a correction.

While these general rules serve as a good foundation from which to base your decisions, it is vital to consider the wider context of an asset's trend before making a decision.

It is important that traders remember that the results of indicators should not be considered in a vacuum but rather interpreted in the context of the overall trading environment. An oversold reading on the RSI of a stock that is trending upwards is likely to be higher than 30%. Similarly, an overbought reading on the RSI of a stock during a downtrend is likely to be significantly lower than 70%.

Moving Averages

As their name suggests, moving averages are used to provide traders with the average price of an asset over a specific period. This is an especially useful tool for traders as the indicator can be adjusted and applied to different lengths of time. This means that the indicator can be used for trades that vary from 5 minutes to several months.

You may be wondering, why would traders care about the average price of an asset? The average price of an asset over a specific period is useful as it can help the trader to identify support and resistance levels. To explain this, let's use a 50-day moving average as an example.

Company X is on an uptrend and currently trading at $100 per share with a 50-day moving average of $99 per share. This moving average details that over the last 50 days the average price has been $99. As a result, it indicates that there is a lot of support at 99$ per share and that the share price will likely bounce once it hits this level as investors attempt to buy it for what they consider to be an average price.

Alternatively, suppose company X's stock is trading at twice the price of its 50-day moving average. In that case, it indicates that the value of the stock will soon likely fall as it encounters increasing resistance.

While moving averages can be useful in estimating levels of support and resistance, the price of an asset does not always respect these levels. It is entirely possible that the price of an asset collapses through support levels into lower lows or smashes through resistance levels to reach higher highs.

As a final point, it should also be noted that moving averages are based on historical price data. This means that moving averages are not predictive and can be the result of random price fluctuations.

There are occasions when the market appears to respect the moving average indicators and other occasions where it does not. It is always the responsibility of the individual trader to assess the asset and determine how much reliance should be placed on these particular indicators.

Moving Average Convergence Indicator (MACD)

Moving Average Convergence Indicators (MACDs) are similar to moving averages in that they are also based upon historical price data. As a result, they are burdened with many of the same limitations as moving averages.

Technical analysts can use a MACD to indicate when there may be a change in a stock price trend. While it is beyond the scope of this article to fully explore this indicator, it can be summarized as follows:

When a MACD passes above 0 it is considered a bullish indicator. Bullish indicators mean that the price is likely to rise. However, the MACD falling below 0 is thought to be a bearish signal and indicates that the price is probable to decline.

Conclusion

Used properly, technical analysis can help traders make a profit. To become a successful trader, you do need lots of practice and discipline.

Another crucial element is a good broker. Visit our comparison page and use our tool to find the right broker for you quickly. It takes only a few minutes, and it's 100% free.

FAQ

The technical analysis of stocks refers to when traders use data and mathematical calculations to analyze specific stocks to forecast whether the price of that stock will rise or fall.

Learning to perform a technical analysis is a challenging task. Those of you who wish to develop this skill will require several different items including access to a brokerage, charting platform, and educational resources.

Technical analysis is largely a self-fulfilling prophecy. It is the result of large groups of people believing in the same ideas and making decisions based on those beliefs. For example, If many people believe a stock will rise, they will purchase that stock. As a result of those purchases, the price of the stock will rise. Had those same people believed the opposite, it is likely the price of that same stock would have fallen.

Find the Best Trading App for YOU

Trade securities cheaper and easier with a brokerage tailored to your needs. Tell us more about your preferences, so we can find the best trading app for you