What is IVV ETF?

iShares Core S&P 500 IVV ETF attempts to match the returns of the S&P 500 Index of large-cap U.S. stocks. The index reflects the performance of the large-capitalization portion of the U.S. equity market.

The expense ratio for the iShares Core S&P 500 ETF is just 0.03%, so you can hold it long-term without worrying about high fees eating into your returns.

The advantages of the IVV ETF include its low expense ratio, its tight spreads between the buy and sell prices, and its diversification across 500 of America's largest companies. These are the main reasons why IVV is considered one of the best ETFs in the USA alongside VOO.

Preliminary Information About the IVV ETF

| Ticker | IVV |

|---|---|

| Issuer | Ishares |

| Expense Ratio | 0.03% |

| Asset under management(AUM) | $303.55B |

| Underlying index | S&P 500 Index |

| Number of Holdings | 503 |

| Average Daily $ Volume | $2.06B |

| Annual Dividend Yield | 1.39% |

IVV Pros and Cons

Pros:

- Very Liquid

- Exposure to 500 + US Stocks

- Low fees

- Worldwide leading issuer

- High dividend yield

Very Liquid: With more than $2 B on average daily volume, you can buy and sell your ETF whenever you wish.

Exposure to 500 + US stocks: Diversification as the holding covers almost all the sectors and industries in the United States.

Low fees: The expense ratio of 0.03% is one of the lowest in the whole market.

Worldwide leading issuer: iShares is a part of BlackRock, the most prominent asset

manager in the world.

High dividend yield: The IVV annual dividend yield is 1.39%, much higher than its competitors.

Cons:

- Only the US

- The price

Only the US: The IVV only invests in US companies, which might be a disadvantage if one day a part of the world takes over the USA as the first economy.

The price: The iShares Core S&P 500 IVV ETF currently trades at approximately $400, higher than other S&P 500 ETFs.

IVV Holdings: Top 10

| Name | Percentage |

|---|---|

| Apple | 7.29% |

| Microsoft | 6.07% |

| Amazon | 3.46% |

| Tesla | 2.05% |

| Alphabet(Google) Class A | 2.02% |

| Alphabet(Google) Class C | 1.86% |

| Berkshire Hathaway Inc. Class B | 1.52% |

| UnitedHealth Group Incorporated | 1.45% |

| Johnson & Johnson | 1.29% |

| NVIDIA Corporation | 1.23% |

iShares Core S&P 500 IVV holdings as of 11/08/2022. Funds may fluctuate over time.

The top 10 holdings of the iShares Core S&P 500 IVV represents 28.39%.

IVV Performance

*Cumulative

| Returns | IVV |

|---|---|

| 1 Month Return | 8.09% |

| 3 Month Return | 5.72% |

| YTD Return | -10.90% |

| 1 Year Return | -3.97% |

| 3 Year Return | 51.59% |

| 5 Year Return | 88.84% |

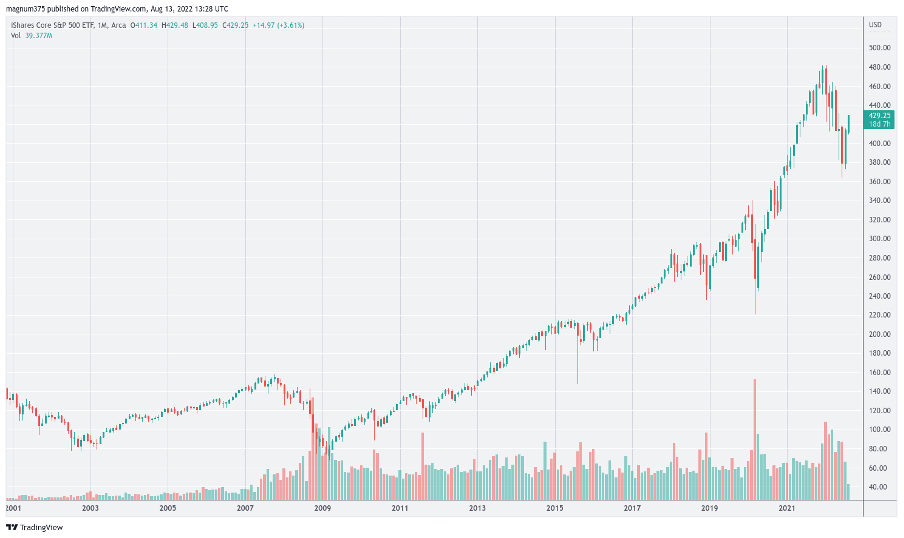

One of the most significant advantages of the IVV is its impressive performance record. The ETF has posted positive returns since its inception. (Except 2000-2001-2008 and 2018)

The cumulative return over five years is 88.84%, a very lucrative investment.

So, for now, Invest in the IVV, wait for at least three years, and let's see the results.

How to Invest in IVV

Step 1: Find the best Investment App

Step 2: Click on it to Open an account

Step 3: Verify your identity and fund your account

Step 4: Buy The IVV ETF.

Conclusion - Should You Invest in the IVV ETF?

Every investor needs to have a liquid asset that he can buy or sell, with low fees and high dividend distribution.

Well, the iShares Core S&P 500 IVV ETF has all those features. For the buy-and-hold long-term investor, this ETF is one of the best choices he can make.