The Verdict

So, sneakers or stocks? What is the best way to invest your money?

Let’s recap!

Sneakers

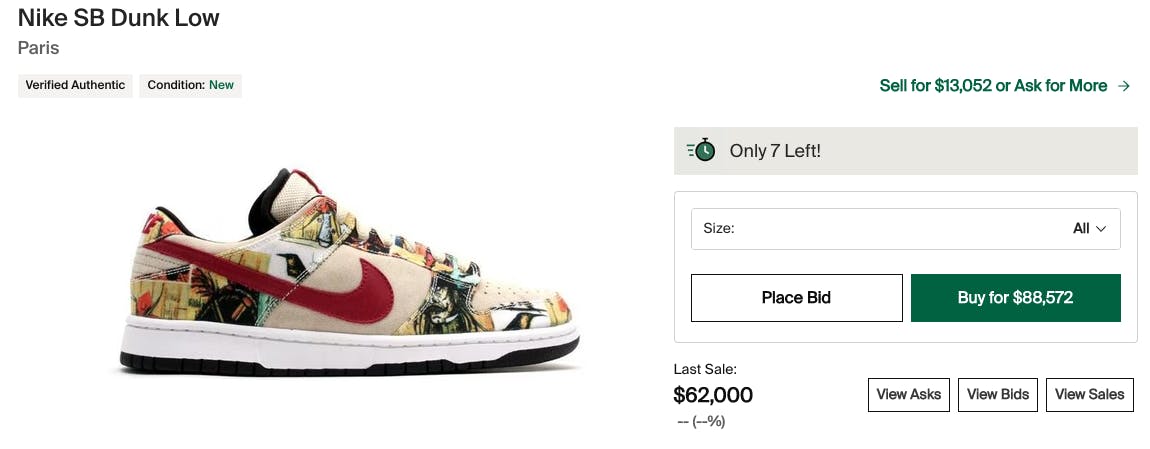

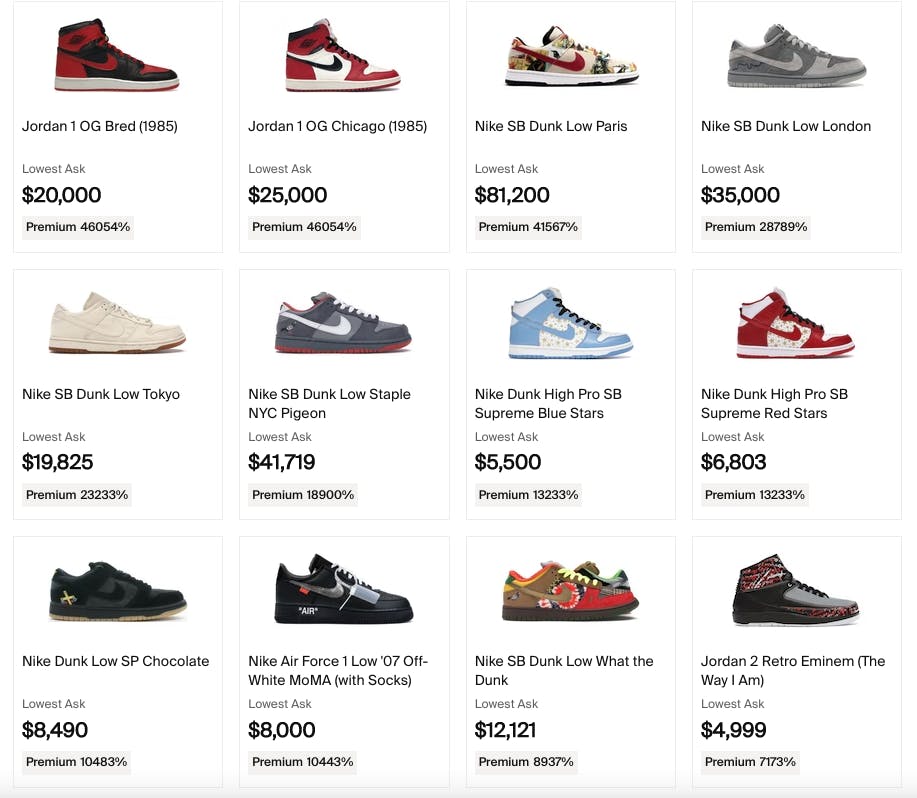

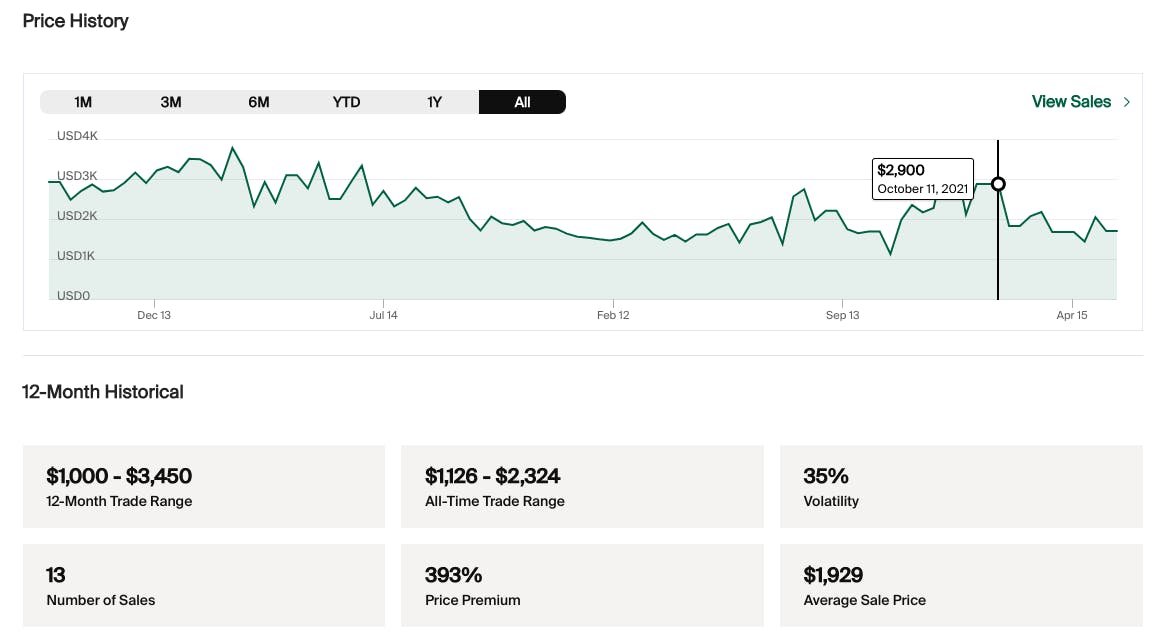

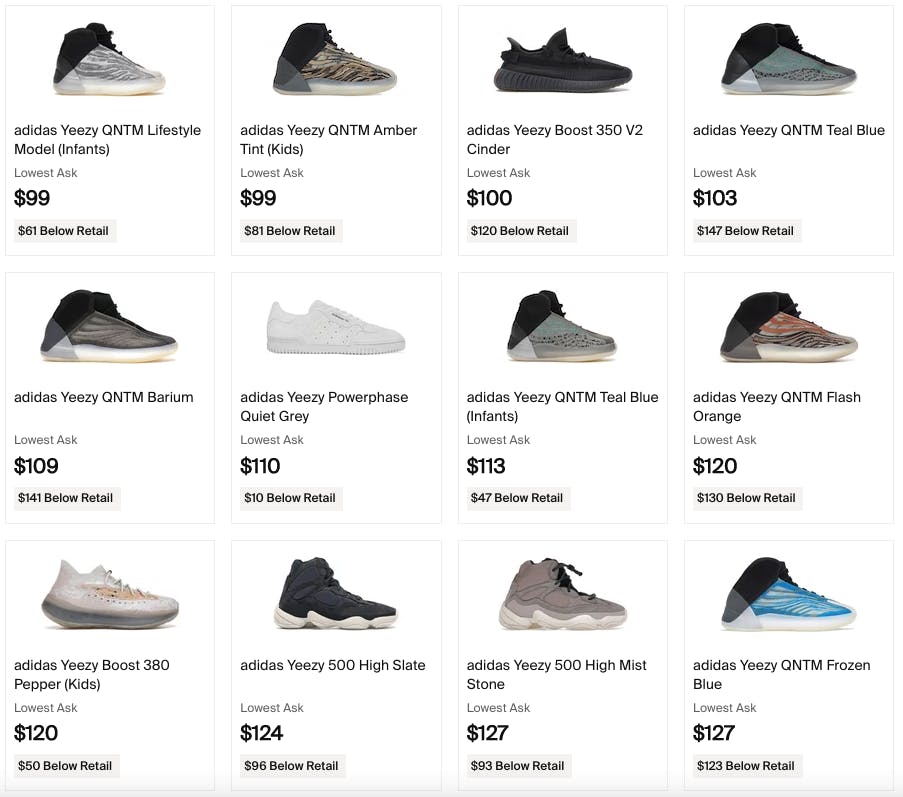

If you want to start investing in sneakers, you will need at least a few hundred dollars, or a thousand, and enough free time to stand in line in front of a sneaker store for a few days. If you’re lucky, you can buy one or two pairs of hyped sneakers, which you could sell in about a week and double or triple your money.

The downside is that you probably won’t have time for a job. Sneaker trading will have to become your unique source of income. This means that, at some point, you will need to develop relationships with store managers and wholesale suppliers to buy sneakers in bulk. Only then will you be able to make a profit that can allow you to make a living from reselling sneakers.

Pros

✅ you can double or triple your money overnight

✅ new sneakers are released constantly

✅ all you need to start is a few hundred dollars

Cons

❌ needs to be a full-time job to make a decent profit

❌ you can take losses on some sneakers

❌ can't buy too many pairs at once

Shares

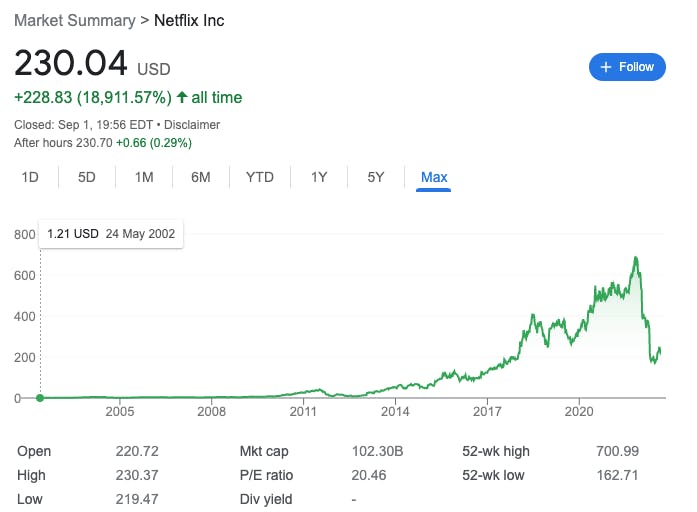

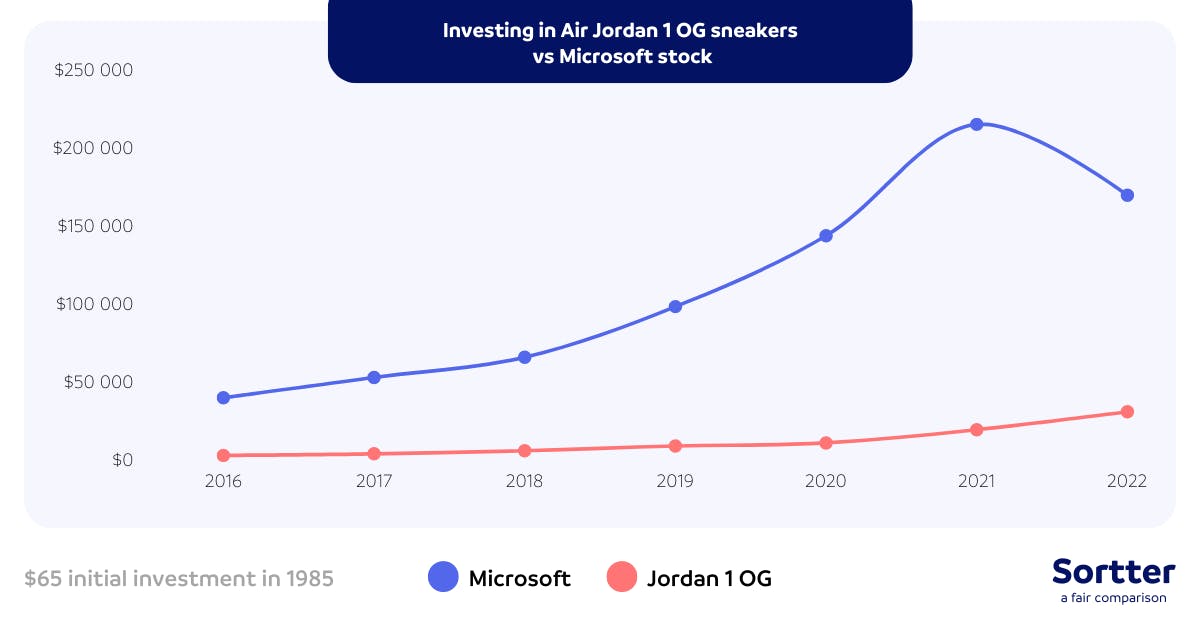

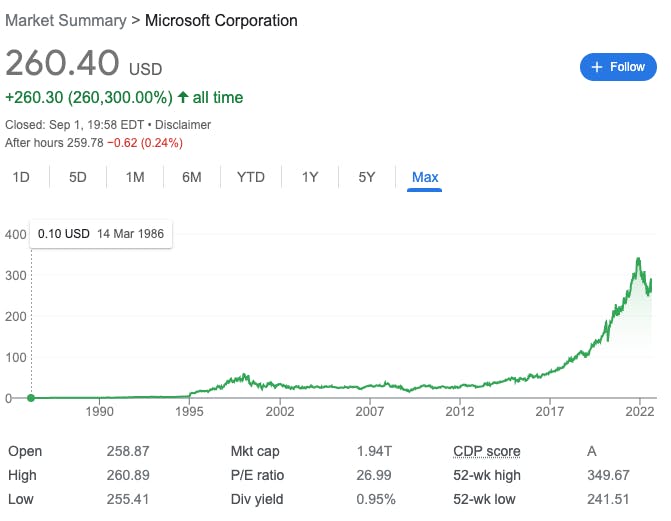

If you want to take a passive approach, the stock market is the way to go. You can invest your money (unlike hyped sneakers, you're not limited to only a few shares) now and then forget about it for the next 30 years. The stock market could be a good way to set some money aside to retire early. But how much money would that bring you?

Let’s say you take that thousand dollars and invest it in today's most popular index fund, the S&P500. On average, the S&P500 had a yearly return of slightly over 11%. This means that, in 30 years, your $1,000 will become almost $23,000. That’s not a lot of money. But what if, besides that $1,000, you start adding an extra $100 each month instead of spending it on sneakers?

Now your total in 30 years will be close to $262,000.

Pros

✅ you can invest as much as you want when you want - even $1

✅ you don't need to quit your job to do it

✅ can have great returns in 2-3 decades

Cons

❌ you can't make a big profit overnight

❌ need to spend a lot of time learning to become a professional investor/trader

❌ can still end up losing money